/ One-Stop-Shop

Capital Placement, Funding & Advisory Services

Specialising in Debt & Equity solutions

for SME developers, lenders, and investors

What is Capital 3

Capital 3 connects real estate developers with strategic debt and equity financing, providing tailored investment solutions across the UK, EU, and US to drive sustainable, long-term success.

Raising Capital

Proven Track Record

A curated selection of successful real estate investments, showcasing our expertise in capital structuring and project execution.

Land Promotion

& Planning

Capital for sites under option or promotion agreements, covering planning and acquisition costs.

Term: Up to 12 months

Structure: Debt and Equity

Region: UK (major cities, selective areas)

Mezzanine Debt

Flexible funding for acquisitions, CAPEX, refinance, and equity release.

LTGDV: Up to 75%

LTC: Up to 90%

Regions: UK, Europe, USA

Ticket Size: £250k – £3.75m

JV & LP Funding

Joint venture structures to reduce equity burden on sponsors.

LTC: Up to 90% of equity requirement

Ticket Size: Up to £3m

Structure: Preferred Equity or Mezzanine Loan

Special Situations

Creative capital solutions for unique or time-sensitive cases to unlock value.

Includes: NPLs, debt workouts, emergency funding, recapitalisations, JV emergency capital, litigation portfolios.

Revolving Credit Facility

Secured capital line for micro and SMEs businesses.

LTV: 75%

Term: Up to 24 months

Ticket Size: Up to £1.5m

Borrowers: Developers, Trading Companies

Portfolio Aggregator Capital

Ordinary equity funding for PropCo + OpCo strategies.

LTC: Up to 100% of equity requirement

Ticket Size: Unlimited

Funding: Institutional investors

Corporate Finance Advisory

Expert guidance for capital structuring, M&A, and strategic funding.

Includes: working capital, M&A, SME lender credit lines, sell-side and buy-side advisory.

About Us

Capital 3 began as an independent advisory firm, supporting small and mid-sized real estate developers in securing funding and navigating investment strategies. Over time, our expertise and network expanded, allowing us to evolve into a full-scale corporate entity with broader capabilities and reach.

Today, we provide end-to-end capital solutions, structuring both debt and equity financing for projects across the UK, EU, and US. Our strategic approach is built to deliver sustainable growth and long-term success for our partners in an increasingly complex financial landscape.

£

m

Total Gross Development Value

Years of Real Estate Investment Experience

£

m

Capital Funded

Lythe Hill Hotel and Spa

Haslemere, UK

Asset class: Hospitality

GDV: £16.6m

Project size: 90 keys

Ticket size: £2.5m

Funding type: Family office + Hedge Fund

Salford Quays

Manchester, UK

Asset class: Commercial

Project size: 1.38 acres/50,000 sqft

GDV: £12.3m

Ticket size: £6.5m

Funding type: Family Offices

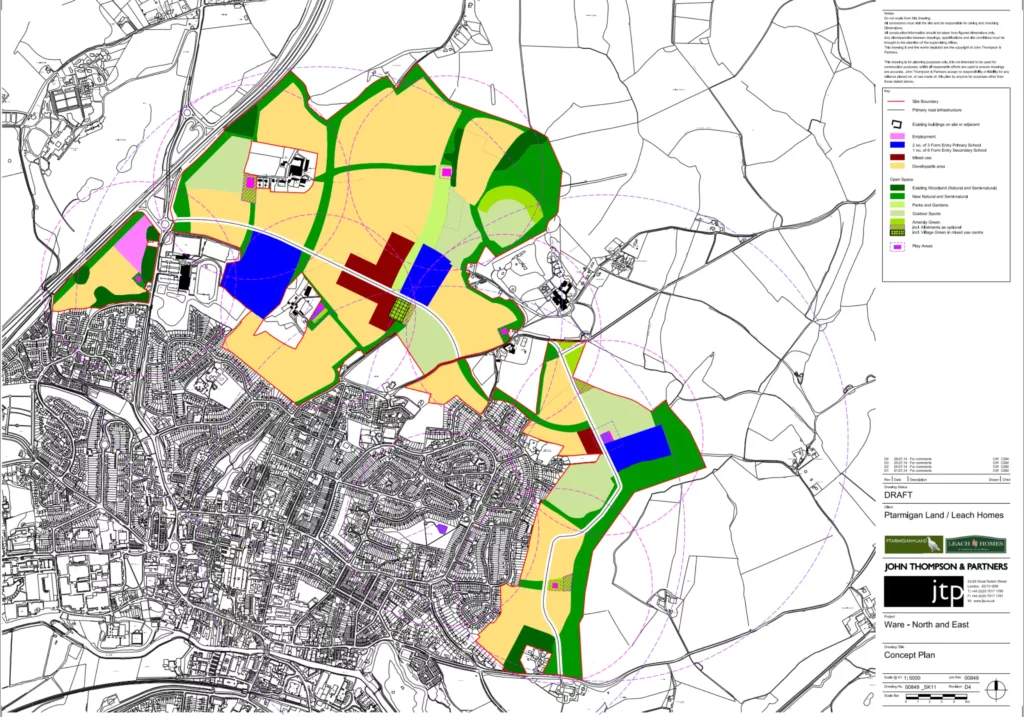

Redellis Land

Ware, Hertfordshire, UK

Asset class: Residential

Project size: 2,972 dwellings

GDV: £142.5m

Ticket size: £6.1m

Funding type: Family office

Malmo Designer Outlet Village

Malmo, Sweden

Asset class: Retail

Project size: 120 units, 173.463m2 GEA, 26.500m2 NIA

GDV: €132.7m

Ticket size: €2.5m

Funding type: Family Office

Hoso Tower

Porto, Portugal

Asset class: Student Housing

Project size: 241 beds

Ticket size: €4.7m

GDV: €24m

Funding type: Family office + Wealth manager

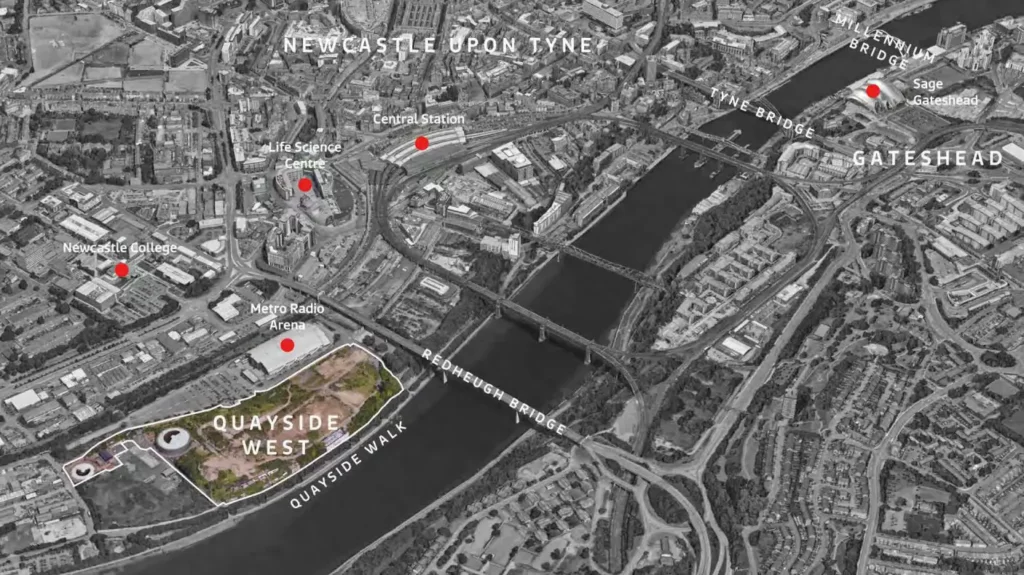

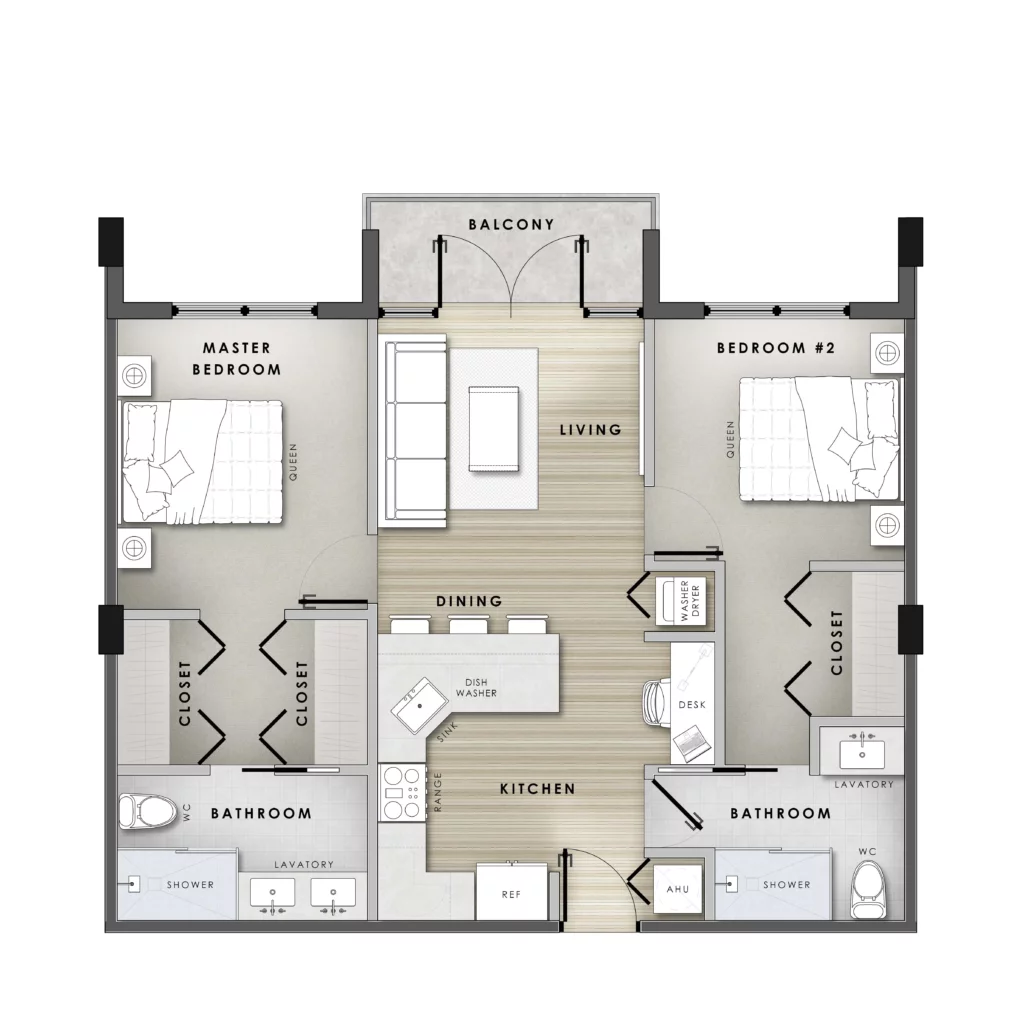

Champions Village

Orlando, Florida, USA

Asset class: Multifamily + Retail

Project size: 482 units

Ticket size: $11.1m

GDV: £114.5m

Funding type: Family office + Wealth manager

Project Map

Our project footprint spans across the UK, Europe, and the US, highlighting the scale and diversity of our funding activity. Each location on the map represents a successful engagement — from capital structuring to full-cycle investment delivery.

Our Process

Our Funding Process Overview

A clear, step-by-step process ensuring every project is thoroughly assessed, securely executed, and closely monitored — from initial enquiry to final repayment.

Enquiry

Meeting with borrowers, sponsors, or brokers to receive an introduction to the project.

01

Assessment

A detailed overview of the project is provided, followed by an internal assessment to evaluate its potential and alignment with funding criteria.

02

Indicative Terms

If the project qualifies, indicative terms are issued, outlining the proposed funding structure and key conditions.

03

Commitment Fee

Upon acceptance of the indicative terms, a commitment fee is paid to initiate the underwriting phase.

04

Underwriting

Comprehensive due diligence includes independent valuations, budget reviews, legal checks, and property assessments, with facility and security documents prepared by legal counsel.

05

Funding

Funds are released once underwriting is successfully completed, all conditions precedent are satisfied, and legal documentation is executed.

06

Monitoring

The project’s progress is actively monitored with regular reporting and site visits to ensure compliance with agreed milestones.

07

Repayment

Repayment of principal and distribution of returns are completed in accordance with the business plan, typically at the point of sale or refinancing of the project.

08

What is Capital 3

What Makes Us Different?

At Capital 3, we go beyond traditional financing. We create strategic, customised capital solutions to help real estate developers and investors achieve sustainable growth and long-term success.

Experience in Private Equity Real Estate (PERE)

Decades of expertise in structuring real estate investments.

Debt & Equity Solutions

Tailored financing structures for optimal capital allocation.

End-to-End Project Management

From deal origination to exit strategy, we guide every step.

International Experience (UK, EU, USA, Middle East)

Deep market knowledge across multiple jurisdictions.

Strong Industry Network

Access to trusted lenders, investors, and strategic partners.

Customised Investment Strategies

Bespoke financial models to fit each project’s unique needs.