Proven Results

Record Built on Delivery

With a track record spanning residential, commercial, land, and special situations, Capital 3 has consistently originated and executed complex transactions across multiple asset classes and geographies.

We deliver strong outcomes across equity and debt investments, aligning capital with opportunity through deep expertise in structuring, underwriting, and active management. This proven approach has earned the trust of institutional investors, family offices, and private partners throughout the UK, Europe, the US, and the Middle East.

Capital 3 focuses on originating and delivering real estate investments with institutional-grade underwriting and tailored capital structures. Our experience spans planning-led opportunities, development finance, asset repositioning, and strategic land deals.

Featured Transactions

Selected Examples of Our Execution

Each transaction reflects our hands-on approach to underwriting, transaction structuring, execution and funding. These examples demonstrate how Capital 3 delivers across consistently structured and funded complex transactions.

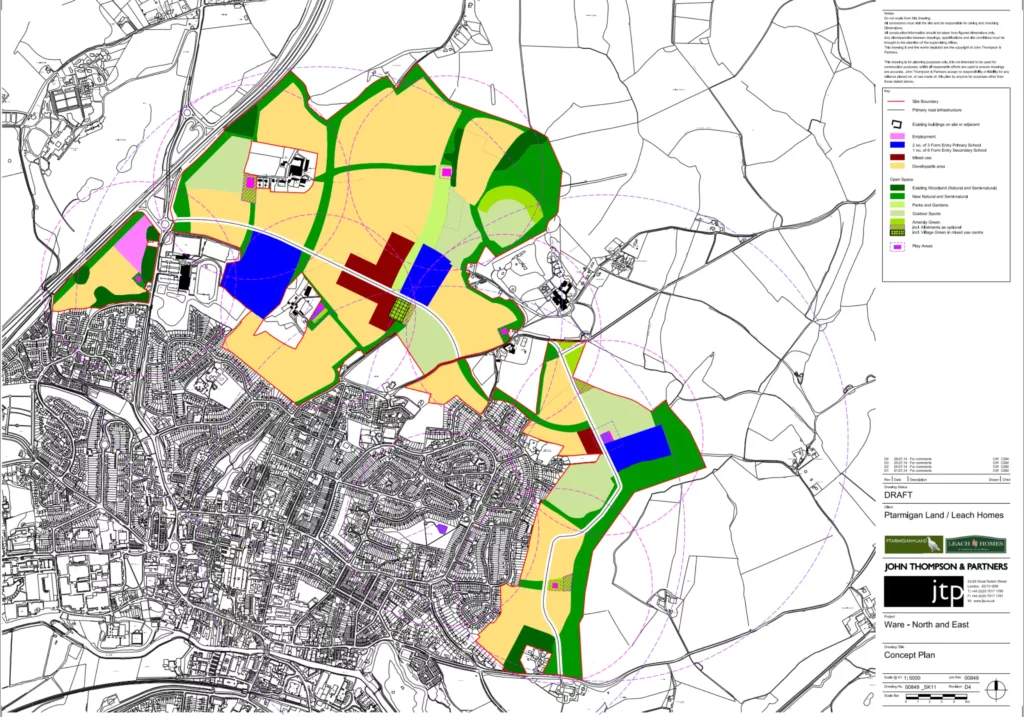

Redellis Land

Ware, Hertfordshire, UK

Asset class: Residential

Project size: 2,972 dwellings

Capital: Special Situations

Ticket size: £6.1m

GDV: £142.5m

Strategy: Planning Play

Funding source: Family office

Capital structure: Mezzanine + JV Funding

Lythe Hill Hotel and Spa

Haslemere, UK

Asset class: Hospitality

Project size: 90 keys

Capital: Planning + Refurbishment + Development Finance

Ticket size: £2.5m

GDV: £16.6m

Strategy: Planning + Development and Stabilisation

Funding source: Family office + Hedge Fund

Capital structure: Mezzanine + JV Funding

Central Hall

Birmingham, UK

Asset class: Hospitality

Project size 222 keys

Capital: Special Situations

Ticket size: £4.1m

GDV: £54.6m

Strategy: NPL

Funding source: Family office + Hedge Fund

Capital structure: Senior + JV Funding

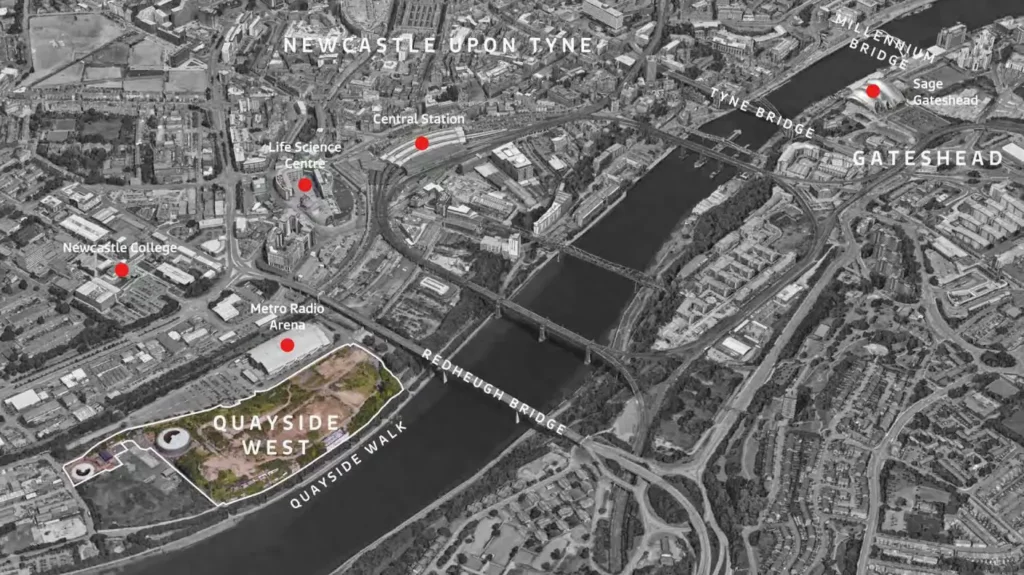

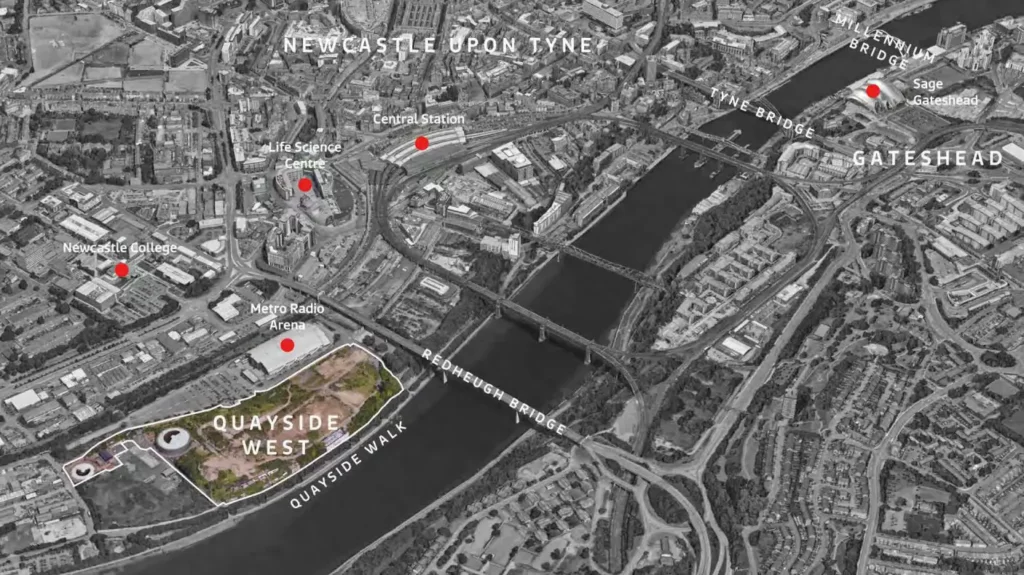

Quayside West

Newcastle, UK

Product: Residential + Hospitality

Project size: 1,200 units + 140 keys

Capital: Special Situations

Ticket size: £2.3m

GDV: £21.8m

Strategy: Planning Play

Funding source: Family office + Hedge Fund

Capital structure: Mezzanine + JV Funding

Salford Quays

Manchester, UK

Product: Commercial

Project size: 1.38 acres/50,000 sqft

Capital: Special Situations

Ticket size: £6.5m

GDV: £12.3m

Strategy: Planning Play

Funding source: Family Offices

Capital structure: Senior + Mezzanine Funding

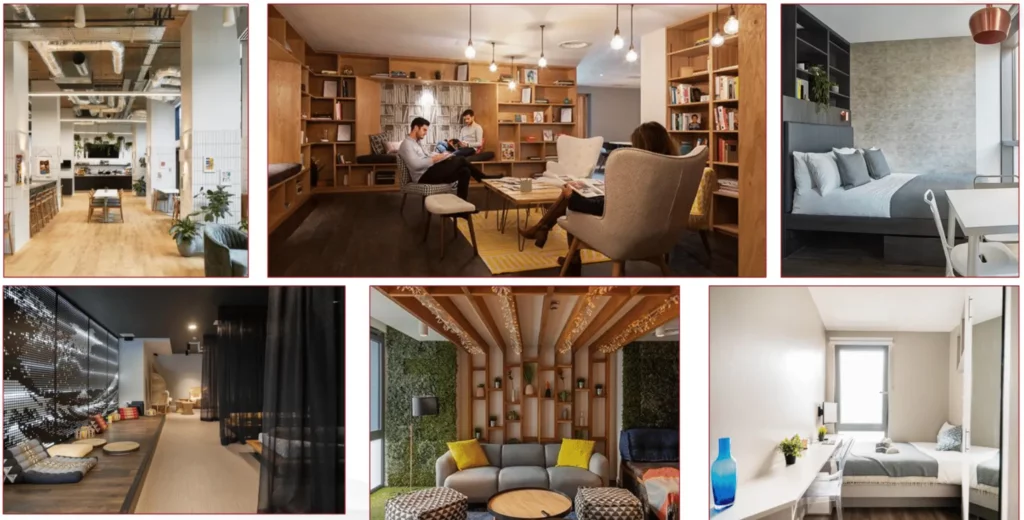

Co-Living Southall

London, UK

Product: Hospitality/Co-Living

Project size: 295 units

Capital: Planning + Refurbishment + Development Finance

Ticket size: £26.85m

GDV: £51.6m

Strategy: Planning + Development and Stabilisation

Funding source: Private Equity

Capital structure: Senior + JV Funding

Ecrin Blanc

Courchevel, France

Asset class: Hospitality

Project size: 1150 keys

Capital: Development Finance

Ticket size: €8m

GDV: €54.1m

Strategy: Development and Stabilisation

Funding source: Family office + Hedge Fund

Capital structure: Senior + JV Funding

Hoso Tower

Porto, Portugal

Asset class: Student Housing

Project size: 241 beds

Capital: Planning + Development Finance

Ticket size: €4.7m

GDV: €24m

Strategy: Planning + Development and Stabilisation

Funding source: Family office + Wealth manager

Capital structure: Bridge + Mezzanine + JV Funding

Malmo Designer Outlet Village

Malmo, Sweden

Asset class Retail

Project size: 120 units, 173.463m2 GEA, 26.500m2 NIA

Capital: Special Situations

Ticket size: €2.5m

GDV: €132.7m

Strategy: NPL + Planning Play

Funding source: Family Office

Capital structure: Senior + JV Funding

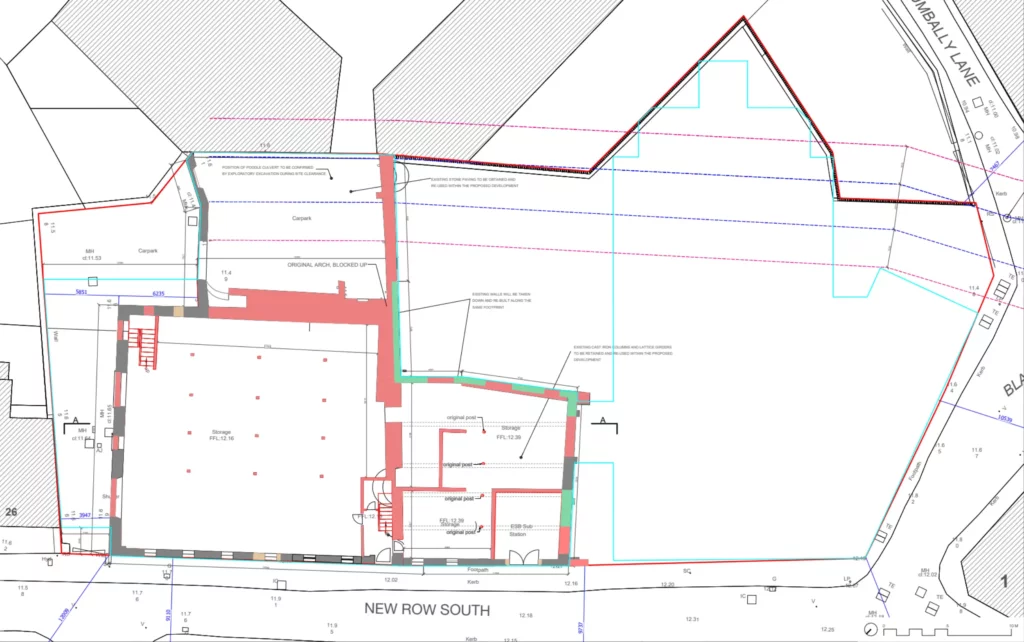

Dublin Staying

Dublin, Ireland

Asset class: Hospitality/Co-Living

Project size: 144 keys + 69 units

Capital: Planning + Development Finance

Ticket size: €3.4m

GDV: €94.7m

Strategy: Planning + Development and Stabilisation

Funding source: Hedge Fund

Capital structure: Mezzanine + JV Funding

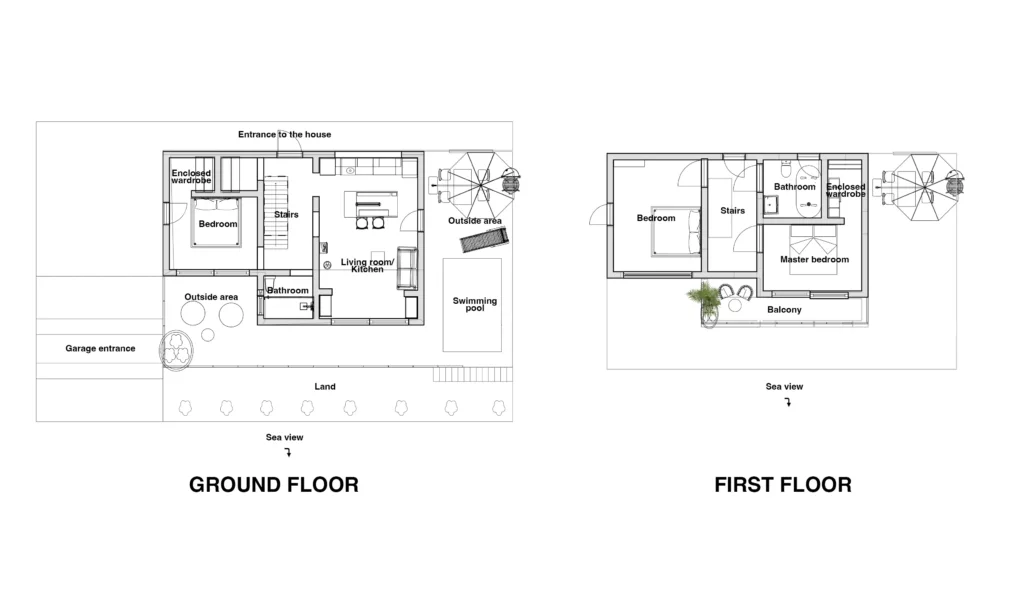

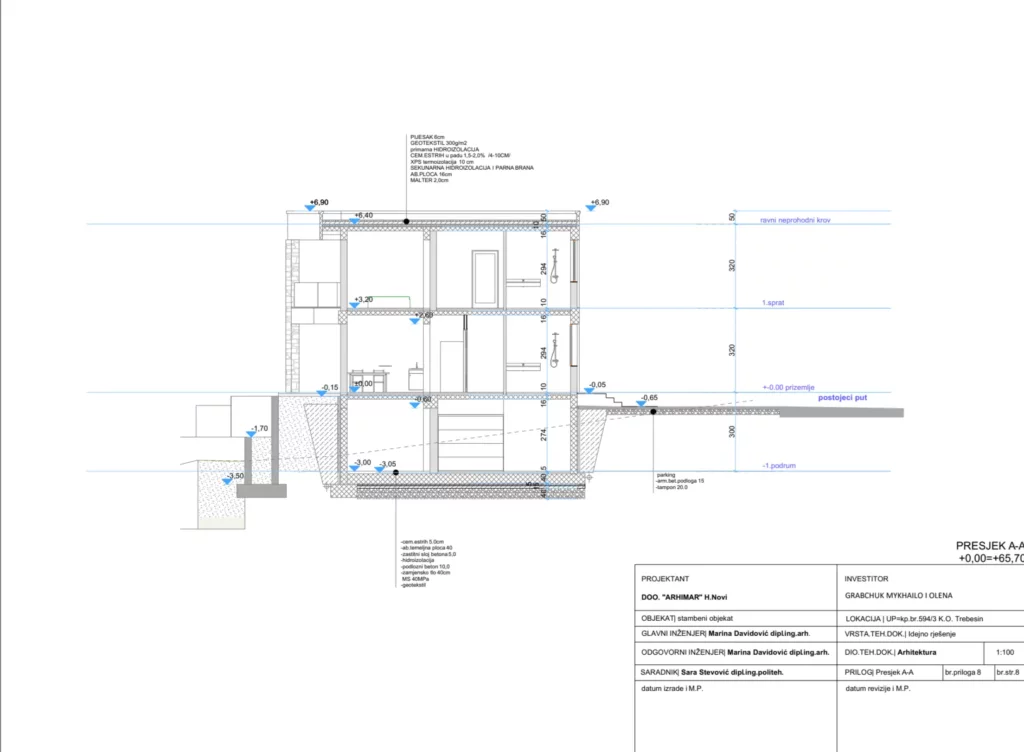

Medi Villas I

Herceg Novi, Montenegro

Asset class: Residential

Project size: 1 villa

Capital: Planning + Development Finance

Ticket size: €0.17m

GDV: £0.45m

Strategy: Planning + Development

Funding source: Family Office

Capital structure: Ordinary Equity + JV Funding

Medi Villas II

Herceg Novi, Montenegro

Asset class: Residential

Project size: 1 villa

Capital: Planning + Development Finance

Ticket size: €0.1m

GDV: £0.5m

Strategy: Planning + Development

Funding source: Family Office

Capital structure: Ordinary Equity + JV Funding

Medi Villas III

Herceg Novi, Montenegro

Asset class: Residential

Project size: 1 villa

Capital: Planning + Development Finance

Ticket size: €0.1m

GDV: £0.5m

Strategy: Planning + Development

Funding source: Family Office

Capital structure: Ordinary Equity + JV Funding

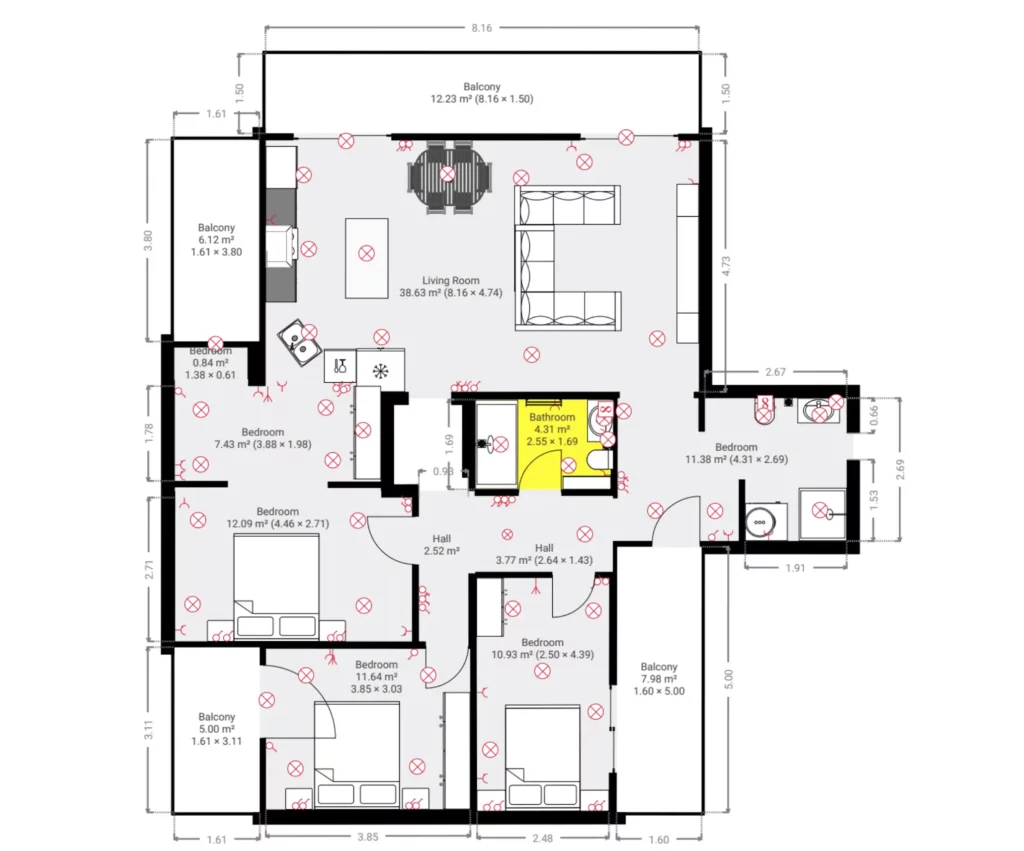

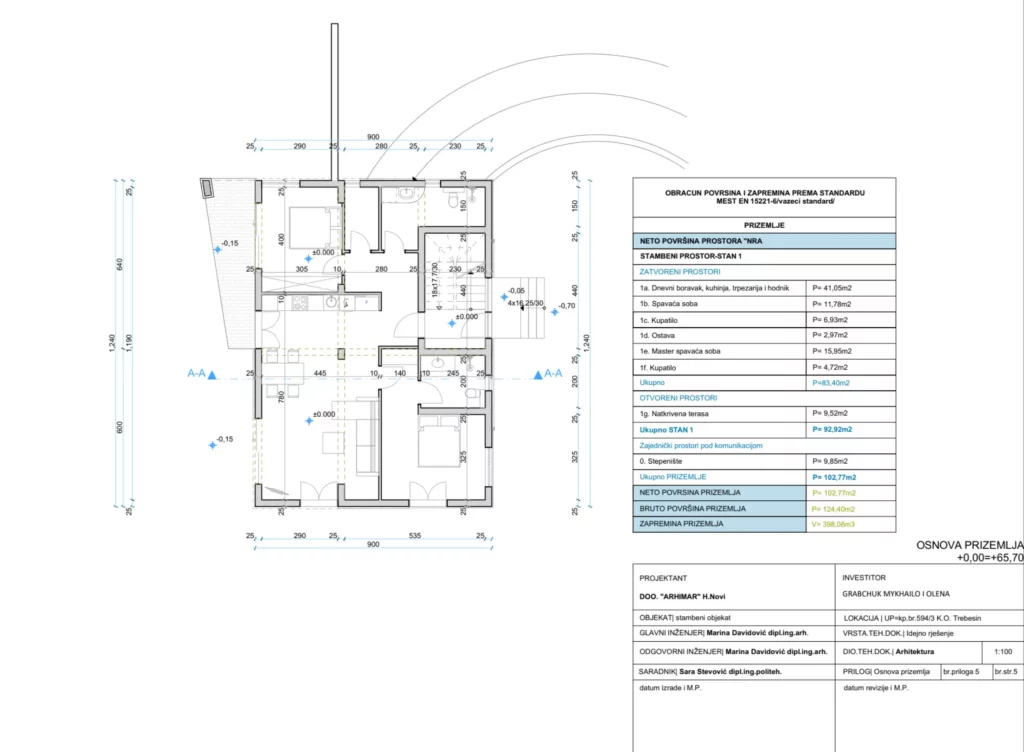

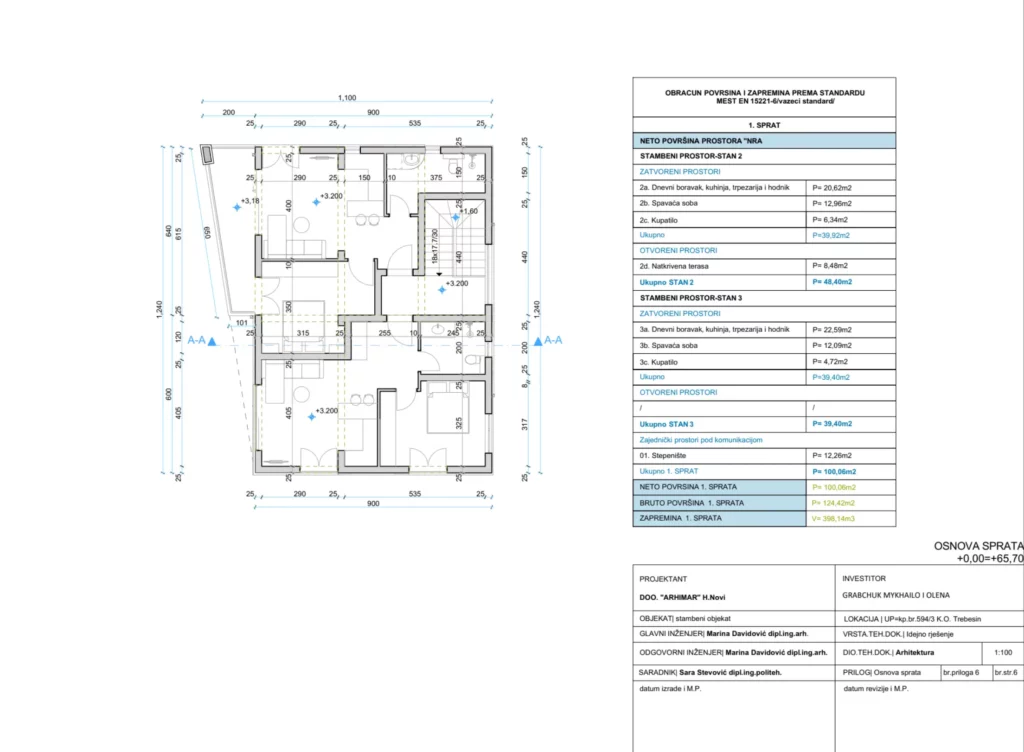

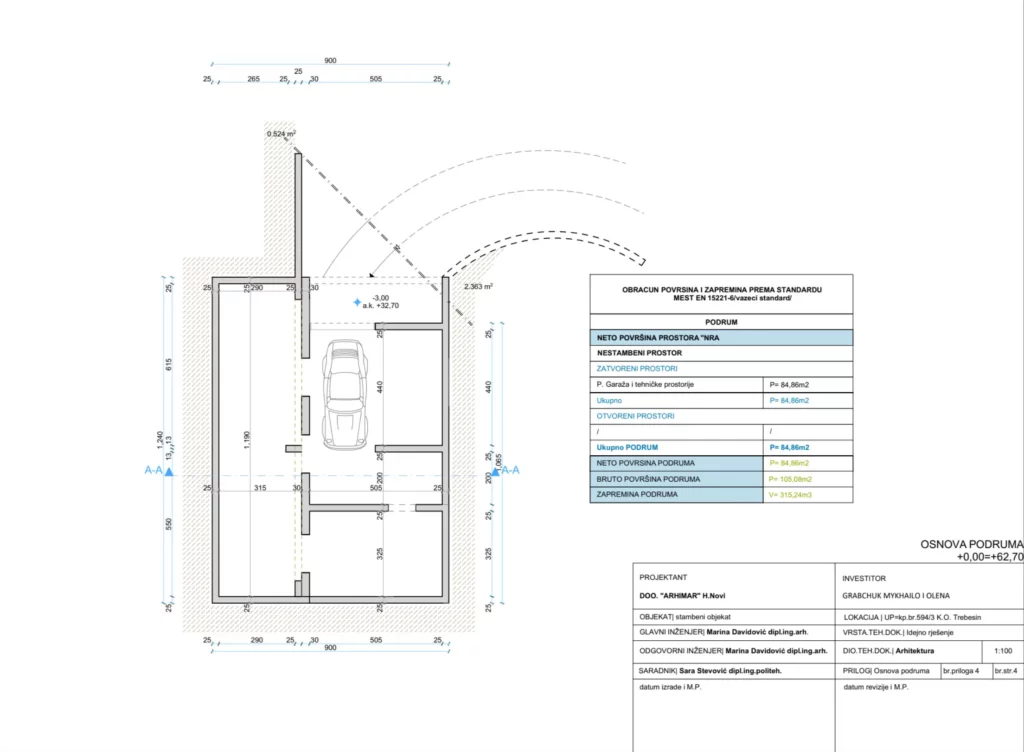

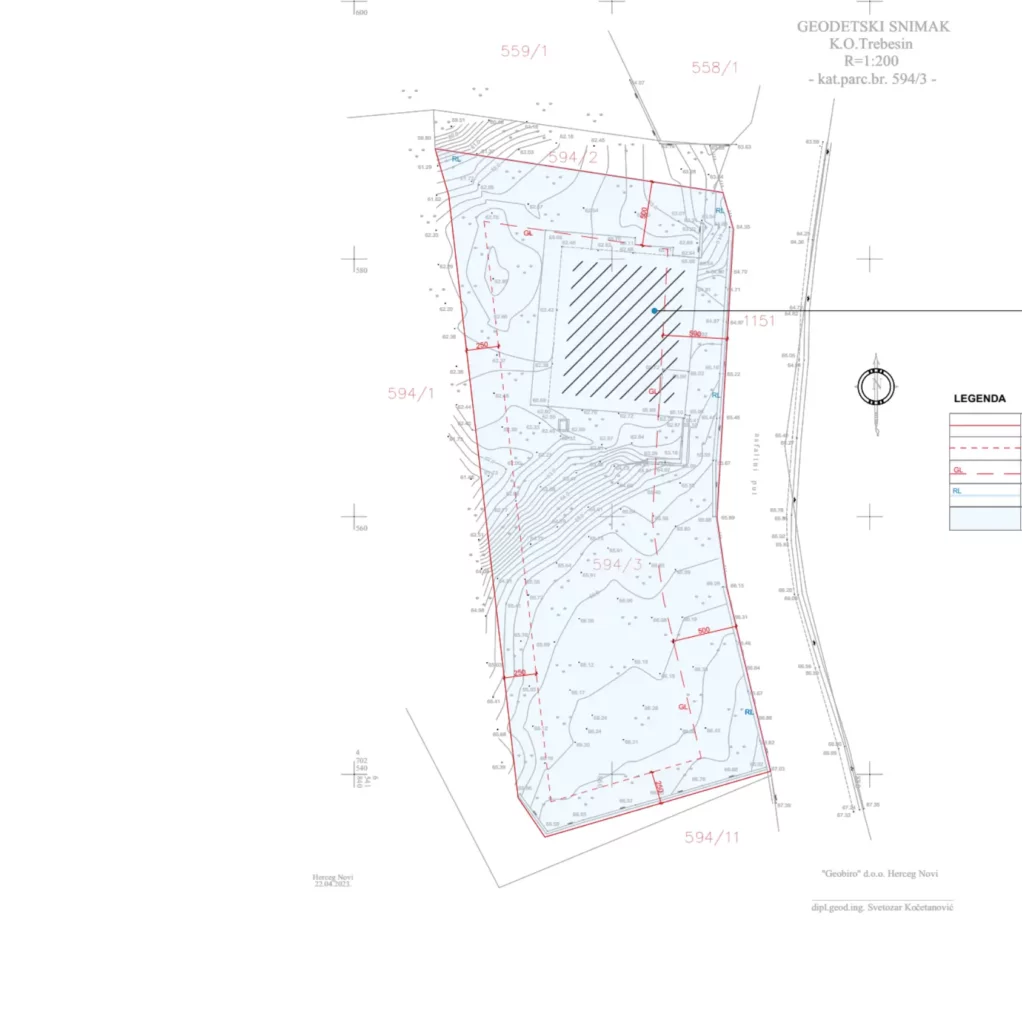

Drenovic Apartments

Herceg Novi, Montenegro

Asset class: Residential

Project size: 3 units

Capital: Planning + Development Finance

Ticket size: €0.3m

GDV: £1.2m

Strategy: Planning + Development

Funding source: Family Office

Capital structure: Ordinary Equity + JV Funding

Maingate Village

Orlando, Florida, USA

Asset class: Multifamily + Retail

Project size: 374 units

Capital: Planning + Development Finance

Ticket size: $10.7m

GDV: £70.8m

Strategy: Planning + Development and Stabilisation

Funding source: Family Office

Capital structure: Mezzanine + JV Funding

Champions Village

Orlando, Florida, USA

Asset class: Multifamily + Retail

Project size: 482 units

Capital: Planning + Refurbishment + Development Finance

Ticket size: $11.1m

GDV: £114.5m

Strategy: Planning + Development and Stabilisation

Funding source: Family office + Wealth manager

Capital structure: Mezzanine + JV Funding

Greenpoint Avenue

New York, USA

Asset class: Multifamily + Retail

Project size: 482 units

Capital: Planning + Refurbishment + Development Finance

Ticket size: $11.1m

GDV: £114.5m

Strategy: Planning + Development and Stabilisation

Funding source: Family office + Wealth manager

Capital structure: Mezzanine + JV Funding

Greenpoint Avenue

Orlando, Florida, USA

Product: Multifamily

Asset Class: 52 units

Capital: Planning + Development Finance

Ticket size: $7.8m

GDV: £44.5m

Strategy: Planning + Development and Stabilisation

Funding source: Family office + Wealth manager

Capital structure: Mezzanine + JV Funding